Introduction

As we progress through 2024, the UK economy faces a landscape marked by both opportunities and challenges. Economic conditions are influenced by a range of factors, including domestic policies, global trends, and market dynamics. This comprehensive guide explores what to expect from the UK economy over the next six months, providing insights into key economic indicators, anticipated trends, and potential challenges. Understanding these factors will be crucial for businesses, investors, and policymakers alike.

1. Economic Growth Projections

1.1 Current Economic Overview

As of mid-2024, the UK economy is experiencing moderate growth. The Office for National Statistics (ONS) reports that GDP growth has stabilized following the turbulence of recent years. The latest data indicates a GDP growth rate of approximately 2.1% year-on-year, reflecting a recovery from previous economic disruptions.

1.2 Short-Term Growth Expectations

In the next six months, the UK economy is expected to continue its modest growth trajectory. Key factors influencing this include:

- Consumer Spending: Consumer confidence is recovering, leading to increased spending. This is expected to contribute positively to GDP growth. Retail sales data suggest a rebound in consumer spending, driven by rising disposable incomes and reduced inflationary pressures.

- Business Investment: Business investment is anticipated to rise as firms adapt to post-Brexit trade arrangements and explore new opportunities. Investments in technology and sustainability are likely to be major drivers of growth.

- Government Policies: Recent fiscal policies, including infrastructure spending and tax incentives, are designed to support economic activity. The government’s focus on boosting productivity and innovation will play a crucial role in shaping economic performance.

2. Inflation and Interest Rates

2.1 Inflation Trends

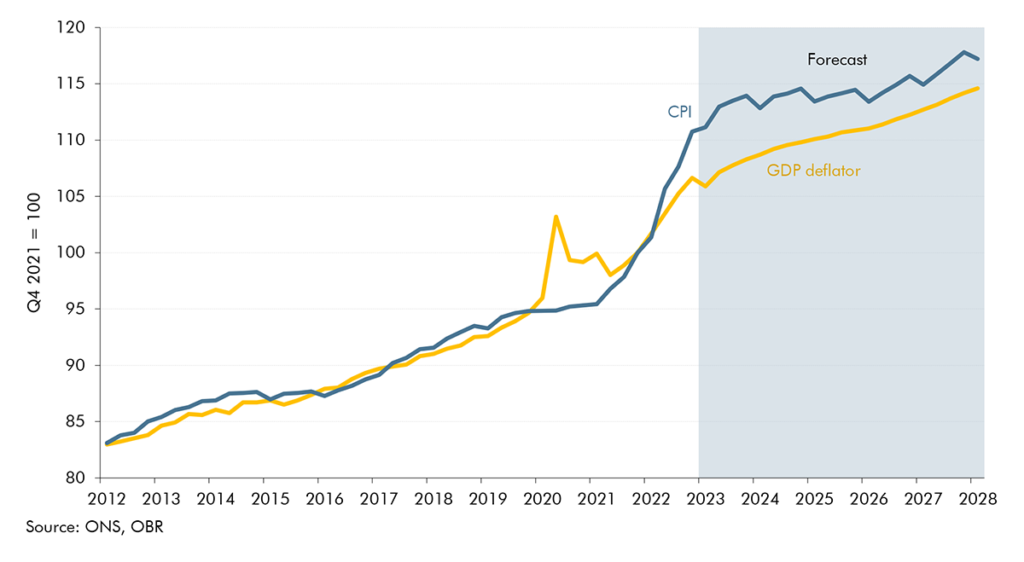

Inflation has been a significant concern in recent years, driven by global supply chain disruptions and increased energy costs. However, recent data shows signs of easing inflation, with the Consumer Price Index (CPI) hovering around 3.0%. Factors contributing to this trend include:

- Energy Prices: Stabilization in global energy markets is helping to moderate energy costs, which had previously contributed to higher inflation rates.

- Supply Chain Improvements: Ongoing improvements in supply chains are reducing cost pressures on goods and services.

2.2 Interest Rate Outlook

The Bank of England has maintained a cautious approach to interest rates, aiming to balance economic growth and inflation control. Over the next six months, the central bank is expected to:

- Gradual Rate Adjustments: The Bank of England may implement gradual interest rate adjustments based on economic data. An increase in rates is possible if inflationary pressures persist, but the approach is likely to be measured to avoid stifling economic growth.

- Monetary Policy: The central bank’s monetary policy will focus on managing inflation while supporting economic recovery. Market expectations suggest that the base rate could see modest increases if inflation remains above target.

3. Employment and Labor Market

3.1 Employment Trends

The UK labor market has shown resilience, with unemployment rates falling to around 4.5%. Key trends to watch include:

- Job Creation: Employment growth is expected to continue, driven by sectors such as technology, healthcare, and green energy. The recovery in the hospitality and retail sectors will also contribute to job creation.

- Wage Growth: Wage growth has been robust, with average earnings increasing in response to a tight labor market. However, wage growth may moderate as the labor market stabilizes.

- Skills Shortages: Certain sectors are experiencing skills shortages, particularly in technology and engineering. Addressing these shortages through training and immigration policies will be crucial for sustaining economic growth.

3.2 Labor Market Challenges

- Remote Work: The shift towards remote and hybrid work models continues to impact various sectors. Businesses will need to adapt to these changes to attract and retain talent.

- Productivity: Improving productivity remains a key challenge. Investments in technology and workforce development will be essential to boost productivity and support long-term economic growth.

4. Trade and International Relations

4.1 Post-Brexit Trade Arrangements

The UK’s post-Brexit trade arrangements are evolving, with new trade agreements and regulatory frameworks coming into play. Key developments include:

- Trade Agreements: The UK has been negotiating trade agreements with various countries and trading blocs. These agreements aim to facilitate trade and reduce barriers for UK businesses.

- Customs and Border Controls: The implementation of new customs and border controls will impact trade flows. Businesses will need to adapt to these changes to ensure smooth operations.

4.2 Global Economic Influences

- Geopolitical Tensions: Global geopolitical tensions, including trade disputes and conflicts, may impact the UK’s international trade and investment.

- Economic Slowdown: A potential economic slowdown in major economies, such as the US and China, could affect global demand for UK exports. Monitoring global economic conditions will be important for anticipating potential impacts on the UK economy.

5. Housing Market

5.1 Current Housing Market Trends

The UK housing market has shown resilience, with house prices remaining relatively stable. Key trends include:

- Price Stability: House prices have stabilized following previous fluctuations. Demand for housing remains strong, particularly in urban areas and regions with high employment growth.

- Supply Constraints: The housing supply remains constrained, contributing to price stability. Increased construction activity and housing developments are expected to alleviate some of these constraints.

5.2 Future Outlook

- Interest Rates Impact: Changes in interest rates will influence mortgage rates and housing affordability. A rise in interest rates could moderate housing market activity.

- Government Policies: Government initiatives to support home ownership and increase housing supply will play a role in shaping the housing market outlook.

6. Sectoral Insights

6.1 Technology and Innovation

The technology sector continues to be a major driver of economic growth. Key developments include:

- Investment in Technology: Increased investment in technology and innovation is expected to drive growth in sectors such as fintech, artificial intelligence, and cybersecurity.

- Start-ups and Scale-ups: The UK remains a hub for start-ups and scale-ups, with supportive policies and access to venture capital fueling growth.

6.2 Green Energy and Sustainability

Sustainability and green energy are becoming central to economic policy. Key areas of focus include:

- Renewable Energy Investment: Investment in renewable energy sources, such as wind and solar power, is expected to increase as the UK aims to achieve its climate targets.

- Green Technologies: The development and adoption of green technologies will be crucial for reducing carbon emissions and supporting sustainable economic growth.

7. Consumer Behavior and Spending

7.1 Consumer Confidence

Consumer confidence has been recovering, leading to increased spending. Key factors influencing consumer behavior include:

- Economic Outlook: Positive economic prospects and improving job market conditions contribute to higher consumer confidence.

- Spending Patterns: Consumers are increasingly prioritizing experiences and discretionary spending, impacting sectors such as travel, dining, and entertainment.

7.2 Retail Sector Trends

- E-commerce Growth: The growth of e-commerce continues to reshape the retail landscape. Retailers are focusing on enhancing their online presence and investing in digital capabilities.

- Sustainability Preferences: Consumers are increasingly prioritizing sustainability and ethical considerations in their purchasing decisions, influencing retail strategies.

8. Conclusion

The UK economy is positioned for moderate growth over the next six months, supported by consumer spending, business investment, and government policies. However, challenges such as inflation, interest rate adjustments, and global economic influences will need to be navigated carefully. Key sectors, including technology, green energy, and retail, will play pivotal roles in shaping economic outcomes.

Businesses, investors, and policymakers should remain vigilant and adaptable, leveraging opportunities while addressing potential risks. By staying informed about economic trends and developments, stakeholders can make informed decisions and contribute to the UK’s economic resilience and growth.